Being late on your credit card payments is costly, and we’re not talking only about penalty fees and higher APR — not paying on time could also have an impact on your credit score thus making it more expensive to borrow money in the future. So making sure to pay on time is a must.

But it could happen to anyone of us. Or not… There are a few things we could do to never miss a credit card payment. We have identified 5 ways to go around this problem and we are sure one of them will work for you. Here goes…

1. Set up auto-pay

The good thing is that most credit card issuers offer this option; if it’s not available, you can set your bank account to automatically transfer money from your checking to the credit card account.

Most credit card issuers let you choose whether you want to automatically pay the full bill amount, a fixed dollar amount, or make only the minimum payment. If you’re getting a credit card that offers rewards, we strongly suggest you make your payments in full and on time.

Setting auto-payments is the best way to do it as you don’t have to remember a thing. However, if you, say, have a history of overdrafts on your bank account, this may not work for you. For automatic payments to work, you must have the money in the bank to cover the payments every time they’re deducted from the account. Otherwise, you’ll be hit with a fee from the bank for insufficient funds, a late fee from your credit card, and perhaps an additional fee for a payment not going through from your credit card.

Another thing to worry about are fraudulent charges on your account. With automatic payments turned on, you will have to look through every monthly bill to determine whether all of the things listed there were actually bought by you. Then again, you should look through that bill anyway.

2. Set up payment alerts

Many banks will let you set up payment alerts so you don’t forget making that month’s payment. Also, there are other, third-party tools you can rely on to accomplish the same thing — like Mint or some other app made to help you keep personal finances under control.

There is one caveat with this method — you can get an alert when you’re “out and about” and later forget to follow through. So if you want to take this route, it’s best to combine it with the auto-payment feature, which you can then set to make minimum monthly payments on your behalf. The reminder will then allow you to pay the rest — or as much as you can — manually.

3. Pay the credit card bill a few times per month

A good strategy — as well as a habit-building process — could be to pay your credit card bill a few times per month. For instance, you can make payments on every 5th, 15th and 25th of the month; or every Monday. Set a recurring event in your calendar to remind you it’s time to pay the dues and follow through. Then log into your e-banking account — most banks also let you do this on your phone — and pay what you owe.

Similarly to auto-payments, by paying your balance every time you get the chance — you can avoid late payments and associated fees they incur. Also, by logging into your bank account more often, you may be inclined to stay on the budget (which you have previously defined for yourself).

This method comes with one caveat though — you can get busy and forget to make a payment. Or you may be travelling and physically cannot do it. Reminders on your phone will help you in either case.

4. Change your due date

Most credit card issuers let you change the due date so you can fit it into your own schedule. And by this we mean aligning it with the time when your other payments are due (like mortgage for example) as well. Or you can set it to the time when you receive your paycheck.

Personally, I like to pay all the bills on the same date, so when all of them arrive — I log into my bank account and make a few transactions. Ten minutes afterwards, I know where I stand for the rest of the month.

It is up to you to select the date you won’t easily forget. Again, your goal is to avoid late payments and all the fees they may incur (along with potential credit score bump).

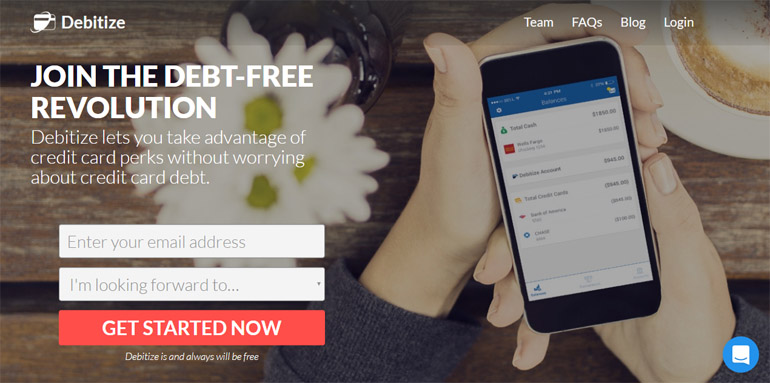

5. Try Debitize

This free service promises to deliver the benefits of credit without risking late payments or debt. It does that by linking your checking account with your credit card account(s), and then automatically setting aside funds as you make purchases with a credit card.

In other words, for most purchases it makes your credit card work like a debit card. This in turn helps some of us limit our sending, avoid late payments and stay out of debt.

The service also offers additional protections designed to help consumers avoid an overdraft. For instance, you can set a minimum balance on your checking account so you always have enough money left to get by.

Another cool feature lets you set up custom notifications to get alerts when you reach a certain spending threshold or if unusual activity is reported. Plus, there’s the option to let Debitize pay your credit card bill automatically. Check it out.

Related: