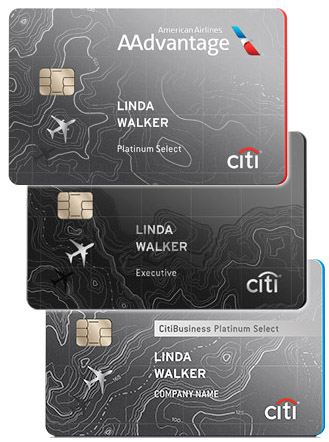

The Citi® / AAdvantage® Platinum Select® MasterCard® and more premium Citi® / AAdvantage® Executive World Elite™ MasterCard® enable frequent American Airlines flyers to get something in return for all the money they spend with the company. Both cards offer sign-up bonuses and a number of perks that will make your flights that much more comfortable. Let’s take a look…

Highlights

Highlights

- 30,000 / 60,000 bonus sign-up miles

- 10% reward rebate with the Citi® / AAdvantage® Platinum Select® MasterCard®

- Admirals Club Membership (worth $400-$500) and $100 Global Entry Application Fee Credit with the Citi® / AAdvantage® Executive World Elite™ MasterCard®

- 15.49% APR

- No foreign transaction fee

- $95 annual fee, waived in the first year / $450

How These Cards Work?

Earn miles: For each dollar spent with either of the two cards you earn one mile in the American Airlines AAdvantage® program, and double miles on purchases from American Airlines. There is no limit to the number of miles you can earn and miles do not expire as long as you earn or redeem miles every 18 months.

Redeem miles: For award flights and cabin upgrades with American Airlines and other OneWorld airline partners, such as British Airways, Cathay Pacific, Iberia, Japan Airlines, Malaysia Airlines, and more. Miles can also be redeemed for car rentals, hotel stays and vacations, as well as Admirals Club membership. With the Citi® / AAdvantage® Platinum Select® MasterCard®, you also receive a 10% rebate on your award redemptions, up to 10,000 AAdvantage® miles each calendar year.

Sign-up bonus: The Citi® / AAdvantage® Platinum Select® MasterCard® offers 30,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening. On the other hand, those signing-up for the Citi® / AAdvantage® Executive World Elite™ MasterCard® will get 60,000 bonus miles after spending $5,000, again within the first 3 months.

Standard shopping and travel benefits: Such as extended warranty coverage, lost luggage insurance, and retail purchase protection (Citi Price Rewind). Also both Citi® / AAdvantage® cards have no foreign transaction fee, making them valid to use both inside the U.S. and when visiting other countries.

First checked bag free: For you and four or eight travel companions on domestic itineraries with the Citi® / AAdvantage® Platinum Select® MasterCard® and Citi® / AAdvantage® Executive World Elite™ MasterCard®, respectively.

Flight privileges: With Citi® / AAdvantage® Platinum Select® MasterCard® users receive boarding privileges with Group 1 on domestic American Airlines flights. The Citi® / AAdvantage® Executive World Elite™ MasterCard® on its end offers priority check-in, airport screening and early boarding.

25% Inflight Savings: Citi® / AAdvantage® cardmembers will receive 25% savings on in-flight purchases of food, beverages, and headsets when purchased with their Citi® / AAdvantage® card. Wireless internet access is not part of the deal, though.

Additional Citi® / AAdvantage® Executive World Elite™ MasterCard® benefits:

- Admirals Club® Membership – providing access to more than 50 lounge locations around the world. This also allows up to two guests on the same trip. These lounges provide such perks as drinks and snacks, Internet access, and PCs, and usually cost $50 per visit or at least $400 per year for an individual membership.

- 10,000 AAdvantage® Elite Qualifying Miles (EQMs) every year after spending $40,000 in purchases between January and December. EQMs are used to earn elite statuses within the AAdvantage® program.

- $100 Global Entry Application Fee Credit – receive one statement credit per account, every five (5) years up to $100, for either the Global Entry or the TSA Pre✓® application fee.

APR: 15.49% – which means you don’t want to carry too much balance with these two cards.

Annual fee: The Citi® / AAdvantage® Platinum Select® MasterCard® costs $95 though the (annual) fee is waived in the first year. On the other hand, the more premium Citi® / AAdvantage® Executive World Elite™ MasterCard® costs $450 per year.

Costs

- 15.49% APR

- 3% Balance Transfer Fee ($5 minimum)

- $0 Foreign Transaction Fee

- $95 Annual Fee (waived for the first year) / $450

Pros

- Sign-up bonus and all the perks that easily justify the annual fee.

- Everyone frequently traveling American Airlines and/or living/working near one of its hubs will want to consider one of these cards.

- First checked bag free alone will justify the annual fee. There are also other flight perks included with all Citi® / AAdvantage® cards.

Cons

- Even though it can be justified with all the perks included, we can’t help but dislike annual fees, no matter how much goodies you get in return. You have to crunch the numbers and see whether it makes sense for you to commit to the card membership.

Head To Head Comparison

Great for Business

Citi and American Airlines have also created a card for businesses, called the CitiBusiness® / AAdvantage® Platinum Select® World MasterCard®. As you are about to see, this card is very similar to the Citi® / AAdvantage® Platinum Select® MasterCard®. Here are the details:

Points: Earn 2 AAdvantage® miles for every $1 spent on American Airlines; 2 miles on purchases at telecommunications, car rental merchants and at gas stations; and 1 mile per dollar on all other purchases.

Points: Earn 2 AAdvantage® miles for every $1 spent on American Airlines; 2 miles on purchases at telecommunications, car rental merchants and at gas stations; and 1 mile per dollar on all other purchases.

Sign-up bonus: 30,000 AAdvantage® bonus miles after spending $1,000 in purchases within the first 3 months of account opening.

American Airlines goodies:

- First checked bag is free.

- Group 1 Boarding on domestic flights.

- Earn an American Airlines Companion Certificate each year after spending $30,000 or more.

- Employee cards at no additional cost, plus earn AAdvantage® miles for purchases made on employee cards.

- Track expenses with annual and quarterly Account Summaries online.

- Save 25% on eligible in-flight purchases on American Airlines flights.

APR: 15.49%

Fees: $95 annual fee, waived in the first year. No Foreign Transaction Fees on purchases.

Are These The Cards For You?

If you often fly American Airlines (or want to do so), the answer is resounding YES. You will be spending money on air travel anyway so why not get something in return. The annual fee may be a deal breaker for some, but we think it’s easy to justify if you fly at least 3 times per year. You’ll get a much more comfortable flying experience in return, along with all other goodies AAdvantage® cards are offering. Plus, when you use these cards outside of the U.S. you won’t be charged foreign transaction fees, which is a big plus in my book. And let’s not forget all the bonus points you’ll get just for signing-up (and after spending a certain amount of money in the first 3 months).