Bitcoin is the darling of the media but it is not the only game in town — there are also other cryptocurrencies out there, some of which hold a huge promise. One of them is Litecoin, which is even more advanced than bitcoin.

So we wanted to take another look at Litecoin and explain the basics. To that end we have prepared answers to 5 basic questions about this cryptocurrency. Let’s roll…

1. What is Litecoin?

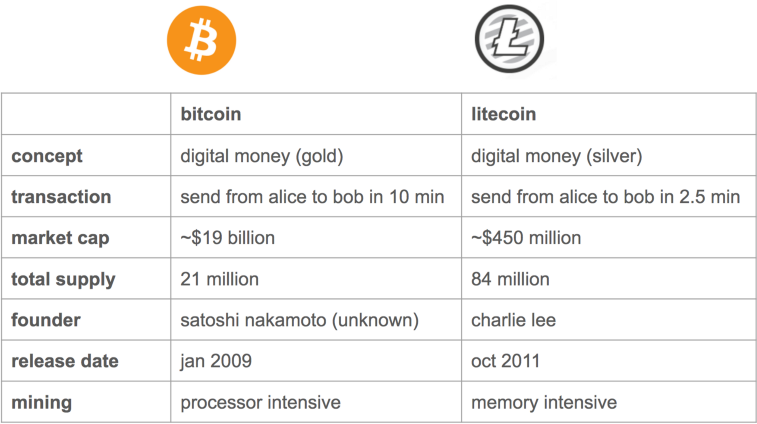

Litecoin is a peer-to-peer cryptocurrency and open source software project released under the MIT/X11 license. Creation and transfer of coins is based on an open source cryptographic protocol and is not managed by any central authority.

Litecoin was released on October 7, 2011 by Charlie Lee — a former Google employee — to coexist alongside Bitcoin and be the “silver to Bitcoin’s gold.”

2. How is Litecoin different than Bitcoin?

The Litecoin Network can process a block every 2.5 minutes, rather than Bitcoin’s 10 minutes, which allows for faster transaction confirmation.

Another difference is in the technology used — Litecoin uses scrypt in its proof-of-work algorithm, a sequential memory-hard function requiring asymptotically more memory than an algorithm which is not memory-hard.

Plus, the platform is set to produce 84 million Litecoins, or four times as many currency units as will be issued by the Bitcoin Network.

3. Are there any benefits of being a smaller platform?

According to Lee, as a smaller platform (than Bitcoin), it is able to take more risk. “Our community is smaller, so it’s easier for us to convince a large proportion of people to upgrade.”

Consequently, the Bitcoin developers sometimes talk to the Litecoin team to see if it will consider an experimental feature, if they are unwilling to take the risk. And so the Segregated Witness (SegWit) was born in May 2017.

4. What is SegWit?

SegWit (Segregated Witness) was first proposed at the end of 2015 to enable Bitcoin to scale faster, but that never happened.

On the Litecoin network, the feature is expected to increase capacity of the transaction throughput, and include some other changes, such as:

- Instant payments – in which security is enforced by blockchain smart contracts without creating an on-blockchain transaction for individual payments.

- Low cost – with off-blockchain transaction, the network allows for exceptionally low fees, which further enables instant micropayments.

- Scalability – SegWit enables millions to billions of transactions per second across the network. Attaching payment per action/click is now possible without custodians.

As noted above, Litecoin could very well be the testing ground for future changes in Bitcoin. Meanwhile, it could also be a solid investment for those looking to experiment with cryptocurrencies.

5. Where can I buy Litecoin?

if you want to buy some Litecoin, you can do that through reputable platforms, namely those which have been selling bitcoins for years.

Today, all major bitcoin exchanges will gladly take bitcoins for Litecoin, with some of them also allowing users to buy it with good ol’ U.S. dollars and/or any other major currency. So if you want to “get into Litecoin,” check out your favorite bitcoin platform…